Gold as a store of value

I’m not a gold bug. I believe gold’s use as an investment and store of value is a historical artifact not well suited to the modern era. When sailing ships ruled the seas it may have been a fine store of value but when spaceships rule the skies it feels, well, a bit leaden. But, still, in the current environment the question needs to be asked: “does gold still have investment value or has it become the fool’s emporium?”

It is exceedingly tedious to sift through the competing and often repetitive claims of gold’s investment value or lack thereof. Attempts at discussion often devolve, and rapidly so, into emotional arguments emanating from rigid positions of gold owner versus non-owner. Such arguments are hardly a useful insight into gold’s value as an investment and thus as a store of value.

The thought occurred to me that if gold was indeed the best investment vehicle and store of value then it ought to handily outperform other investment vehicles over extended periods of time. On that premise I determined to compare the long term spot price of gold versus the long term Dow Jones Industrial Average (DJIA). Such a head to head comparison might be able to determine the relative value of either investment vehicle as a long term store of value. In this process I arbitrarily assume that the better investment vehicle is therefore, the better store of value.

Of course, if gold or the DJIA does not provide a net positive return then it fails as an investment and also as a store of value. Thus we need to first determine if either vehicle provides a long term positive return. If so, then we can compare those returns to determine which vehicle is better. So, does either provide a positive return? Which is the better investment: gold or the DJIA?

It depends

As is too often the case the answers to both questions are disappointing. Do gold and the DJIA provide a positive long term return? It depends. Which is the better investment? It depends. What do these answers depend upon? They both depend upon the time period selected. Pick one time period and neither is positive. Pick another and both are positive. Pick a third time period and gold handily outperforms the DJIA. Pick a fourth time period and the DJIA buries gold. Let’s take a closer look to better understand the importance of the time period in answering these two questions.

I confess that I am not a mathematician but a small time investor and trader. My objective is to find investments that preserve my capital and provide a net, positive, real rate of return. Given an opportunity I will of course, pick the higher, risk adjusted, rate of return over the lower. Who wouldn’t? With stocks having fallen some 50% over the past year the gold bugs are out in force. Having been inundated with the buy gold, buy gold, buy gold mantra in the news media, blogs and commentary I have decided to examine gold more closely. Being at best agnostic about gold I wanted to find out if I am wrong and the gold bugs are right or if my negative intuitive response was more appropriate.

The data

I have obtained the annual DJIA values from 1899 through 2008. I have also obtained spot gold prices over the same time period. Since I am examining both vehicles as long term investments rather than as short term trading vehicles I contend that annual prices are sufficient for my examination. To buttress that contention I note that it is exceedingly rare for any gold bug to ever recommend selling gold. And, clearly the most profitable investor of our time, Warren Buffett is a self-described buy and hold investor. Thus I believe annual data is sufficient for a long term investor.

Within the time period available, 1899 through 2008 some anomalies exist. The biggest is that up until 1933 the price of gold was fixed at $20.67. It is not a fair comparison when one investment vehicle is fixed in price while the other enjoys a measure of volatility. Most of my comparisons then are relegated within the time frame of 1933 through 2008. Even so it is interesting to note that from the bottom of the Great Depression (1932) through 1941 (the start of WWII) the DJIA more than doubled while the price of gold languished.

The importance of time

In a previous existence during the Neanderthal period of personal computer technology I spent way too much time examining various rules based trading strategies. Looking back at those efforts it slowly became apparent that the time period of the data played a much greater role in the outcome of those strategies than was initially evident. Now, at a somewhat riper age one of my first questions regarding investment returns and data is, “over what period of time?” Even more important is the second question, “why that time period?”

As an example, the annual price of gold was in a long term downtrend from 1980 through 2000. The spot price declined by over half from a high of $641 in 1980 to a low of $272 in 2000. Over this same time period the DJIA increased by 1000% from 964 in 1980 to 10787 in 2000. Any comparison of gold versus DJIA over this twenty year period is overwhelmingly in favor of the DJIA.

Let’s take another time period. From 1965 through 1981 the DJIA languished from a high of 969 in 1965 down to 875 in 1981 before embarking on a twenty year bull market. Gold also languished from 1965 to 1971 but starting in 1971 gold rallied from 35 to over 430, a 1200% gain. This time the results are overwhelmingly in favor of gold. But does this tell us, as long term investors, which is the better investment?

It still depends

Table 1 below depicts the simple percentage change, or rate of return on a long term investment in the DJIA and gold. The returns are based upon the change in value over a selected period of time. The change in the DJIA value from 1899 through 2008 is 13252% while the change in spot gold over the same period is only 4383%. Since spot gold was fixed from 1899 through 1932 I next looked at the period 1933 through 2008. During that time the DJIA change in value was 8795% while spot gold only gained 2767%. The next data line looked at the post WWII period to the present (1946-2008). The results were similar if not so dramatic.

|

Table 1

Dow Jones Industrial Average vs. Historical Spot Gold

|

|

Percent change in value over indicated time period

|

|

DJIA

|

13252%

|

1899-2008

|

4383%

|

Gold

|

|

DJIA

|

8795%

|

1933-2008

|

2767%

|

Gold

|

|

DJIA

|

4853%

|

1946-2008

|

2323%

|

Gold

|

|

DJIA

|

3628%

|

1950-2008

|

2202%

|

Gold

|

|

DJIA

|

1325%

|

1960-2008

|

2439%

|

Gold

|

|

DJIA

|

1481%

|

1970-2007

|

2116%

|

Gold

|

|

DJIA

|

946%

|

1970-2008

|

2365%

|

Gold

|

|

DJIA

|

810%

|

1980-2008

|

45%

|

Gold

|

|

DJIA

|

233%

|

1990-2008

|

119%

|

Gold

|

|

DJIA

|

-19%

|

2000-2008

|

241%

|

Gold

|

|

DJIA

|

23%

|

2000-2007

|

206%

|

Gold

|

The remainder of Table 1 depicts the start of a series of time periods to the present, with two exceptions. Given the dramatic selloff in the DJIA and the dramatic rise in spot gold over 2008 I also took a quick look at some results as if the data ended in 2007. These are the periods from 1970 through 2007 and the current decade, 2000-2007. Excluding 2008 data does not alter the direction of the overall results just the magnitude. These are simple calculations, value at start of period (technically end of prior year) versus value at end of period expressed as a percentage of starting value.

What this table depicts is that neither the DJIA nor gold is “THE” single best investment over all time periods and economic conditions. It clearly shows that the time period, which is to say the economic circumstances of a time period, is the determining factor as to which is the better investment.

Value of $1000

I next looked at the data in a slightly different manner, value of $1000 over a selected time period. By only examining data points at the start and end of a time period the ebb and flow of an investment is masked. While the volatility of an investment is important for long term investors, my objective was to examine the value of $1000 during the selected time period in hopes that would provide additional useful information towards determining which asset is the better investment. Table 2 below shows the value of $1000 at the end of a series of selected time periods.

The results shown in Table 2 were calculated by assuming an initial $1000 investment in each asset using the prior yearend value. That is, for the time period of 1933-2008 the yearend value of 1932 is used to initiate the investment. For the period 1970-2008 the yearned value of 1969 was used as the basis. The investment value was then adjusted up or down depending on the percentage change in each of the asset values as of yearend. The percent change was simply calculated as (last value – first value)/first value expressed as a percent. Table 2 shows the end results of this ebb and flow over various time periods.

|

Table 2

Dow Jones Industrial Average vs. Historical Spot Gold

|

|

Growth of $1000 over indicated time period

|

|

DJIA

|

$145,642

|

1933-2008

|

$44,834

|

Gold

|

|

DJIA

|

$10,966

|

1970-2008

|

$26,179

|

Gold

|

|

DJIA

|

$10,464

|

1980-2008

|

$1,601

|

Gold

|

|

DJIA

|

$3,188

|

1990-2008

|

$2,138

|

Gold

|

|

DJIA

|

$763

|

2000-2008

|

$3,223

|

Gold

|

Table 2 vividly shows the impact of the different time periods. From 1970 to 2008 gold handily outperforms the DJIA yet starting ten years later, 1980 to 2008 reverses that outcome by a dramatic margin. What happened to change the outcome so dramatically? The obvious answer is that during the mid 1970’s through the early 1980’s the economy was in a serious slump while inflation was raging to historical levels. Stocks were in the cellar while gold was going through the roof. But by the early 1980’s that circumstance had turned. The economy recovered, inflation was abating and gold was declining.

A similar circumstance appears today. Although inflation has yet to rage the economy is in a serious slump (clearly a recession, perhaps a depression) and the price of gold has once again risen to historical levels. Gold bugs are ubiquitous and the economic panic and fear is feeding the frenzy. But does that make gold a better long term investment than equities?

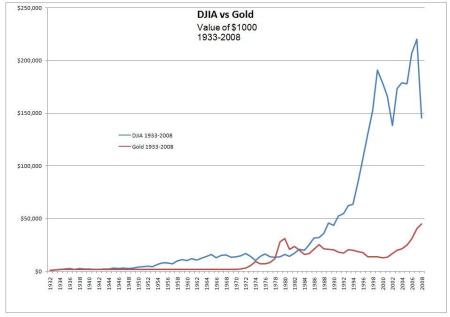

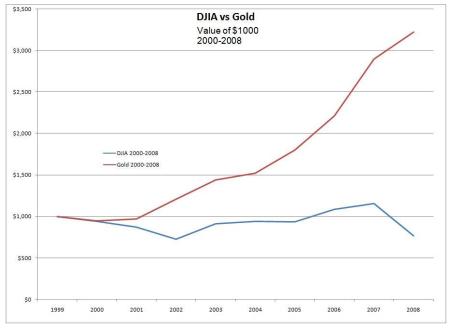

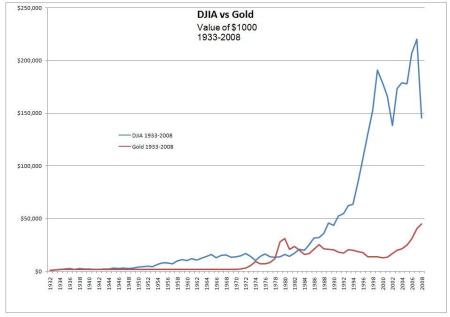

Charts

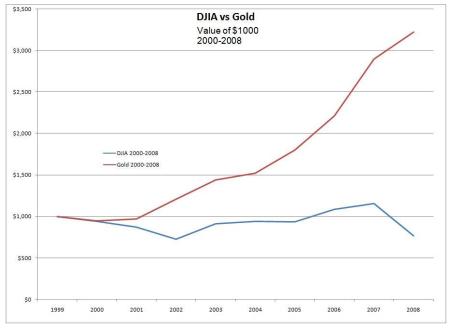

Chart 1 (shown below) depicts the annual change in value of a $1000 investment in both the DJIA and spot gold from 1933 through 2008. As the chart depicts the DJIA appears to exceed gold as an investment in all periods except during extreme financial stress. This is evidenced by the value of the gold investment reaching and exceeding that of the DJIA beginning in the mid 1970’s and persisting until the early 1980’s. This period was the worst post WWII recession until the present time. A similar pattern exists during the period from 2000 through 2008 as shown in Chart 2 (shown below). The DJIA shows great volatility with the end result being a severe downturn through the present time.

The economic circumstance that is missing however may be the proverbial 800# bear in the room. So far, inflation is not raging and there are serious people who believe deflation is the more likely event. Is it possible that the gold bugs have acted quite rationally – but too early – to defend against the government’s monetary and fiscal response to the economic turmoil?

Chart 1

DJIA vs Gold Value of $1000 1933-2008

Chart 2

DJIA vs Gold Value of $1000 2000-2008

While gold bugs may have acted early their combined response has until recently been self fulfilling. Gold has risen from its 1980’s doldrums (after having reached a nadir in 2000) to record highs as of late. What isn’t clear is whether this is a trend that will continue. Note that gold at $2000 has been bandied about much like oil at $200 a barrel was bandied about in mid 2008. Still, there is no denying that gold has seriously outperformed the DJIA over recent years and most especially this last year. But reasonable people can point to the triple economic shocks of (a) the 2000 tech stock bust; (b) the 9-11 attacks in 2001; and (c) the housing/equity bust of 2007-2008 as the reason for the sub-par DJIA. Clearly there have been rational reasons to put more trust in gold over the past eight years. But does that make it the better investment for long term investors?

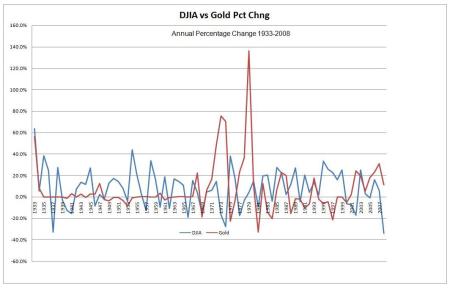

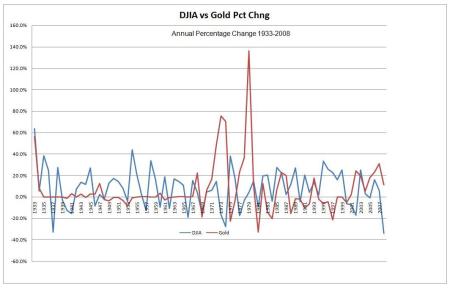

Chart 3

DJIA vs Gold Percent Change in Value 1933-2008

Percentages

Chart 3 above shows the percentage change in value, as of yearend, for gold and the DJIA over the period 1933-2008. These percents are simple calculations of yearend price minus prior yearend price divided by the prior yearend price expressed as a percentage. This chart avoids the starting point distortions evident in the Change in Value of $1000 charts. It also clearly shows the two periods when gold substantially outperformed the DJIA. Gold substantially outperformed the DJIA during the limited period of 1972-1974 and again during 1978-1981. There are other years when gold outperforms the DJIA but none as substantial or long lasting.

My Answer

I’m at best agnostic about gold. I wanted to find out if gold was in fact a better long term investment than equities as typified by the DJIA. I believe that the data has given me an answer: it depends. Whether gold or the DJIA is a better investment depends on the economic circumstances. More specifically gold appears to depend on having a substantial rate of inflation and expectations of future inflation in order to outperform the DJIA. If those expectations are absent then the DJIA outperforms.

After gold hit its record high price in 1980 it slumped for some twenty years while the DJIA had a twenty year bull market. What happened is that inflation expectations were crushed as the government took steps to break the inflation cycle. The key factor in that case is the government correcting the economic issues of recession and stagflation thereby setting the stage for an economic recovery.

When the DJIA gets run over by its own malfeasance or by exogenous factors it too tends to slump for extended periods, circa 1965-1981, 2000-2002 and also 2008-2009. But again, when investors determine that corrective actions are underway that slump (hopefully) ends. Thus rational investors must make a determination as to whether the corrective actions of government are in fact starting to resolve the economic malaise. They must also make a valiant effort to forecast future economic circumstances and from there choose gold or equities.

Inflation or Deflation

Much of the talk today is of the extraordinary government monetary and fiscal response to the economic downturn as an inflationary factor. Even worse, this government response is a global phenomenon unlike mere national recessions of the past. Counter-balancing that are the severe credit restrictions coupled with a substantial downturn in global demand as a deflationary factor. How one interprets the outcome of these factors will determine whether gold or the DJIA is the chosen investment instrument.

One comment I read made a salient point. The unused factory capacity in China, India and the Far East is enormous. Indeed, domestic capacity as well is severely underutilized. Further, inflation is a monetary phenomenon that requires excess capital chasing too few goods. As well, deflation too is a monetary phenomenon but it requires excess goods chasing too little capital. But if the existing supply and potential supply of goods is substantial relative to demand (capital) then perhaps, just perhaps there will be insufficient capital to fully utilize all available supply. Hence, inflation may not be the 800# bear most of us believe it will become. Instead we may actually face a deflationary cycle for the first time in many generations.

This conundrum is explained by the velocity of money. As an aside capital in this case includes the money supply and the velocity of money or how fast a given dollar gets used. Velocity is currently restrained for a variety of reasons and those reasons may not recede quickly or ever. Baby boomers tend to sway the economy out of proportion to their numbers. If boomers (like me) have permanently changed their consumption habits then it is unlikely that monetary velocity will quickly resume at prior levels. Or, at the least it will not resume anytime soon.

Bottom Line

If your estimation is that future inflation is the most likely prospect then buy gold (IAU, GLD). If your estimation is for deflation then bonds (BND, HYG, LQD) are the better investment. If neither prospect seems most likely then you should select equities (DIA, SPY, QQQQ) to outperform both investments. Pick your poison.